See This Report about Stonewell Bookkeeping

Wiki Article

Our Stonewell Bookkeeping Diaries

Table of ContentsThe Facts About Stonewell Bookkeeping UncoveredFascination About Stonewell BookkeepingStonewell Bookkeeping Fundamentals ExplainedThe 7-Minute Rule for Stonewell BookkeepingThe 7-Second Trick For Stonewell Bookkeeping

Instead of going through a filing cabinet of various records, invoices, and receipts, you can provide thorough records to your accountant. After using your accounting to file your taxes, the Internal revenue service might choose to execute an audit.

That funding can come in the form of proprietor's equity, gives, business fundings, and investors. Investors need to have a good concept of your service prior to spending.

Stonewell Bookkeeping Fundamentals Explained

This is not planned as legal recommendations; for additional information, please go here..

We answered, "well, in order to know just how much you require to be paying, we require to recognize just how much you're making. What are your profits like? What is your take-home pay? Are you in any debt?" There was a lengthy time out. "Well, I have $179,000 in my account, so I guess my earnings (earnings less expenditures) is $18K".

The Definitive Guide to Stonewell Bookkeeping

While maybe that they have $18K in the account (and also that may not be true), your balance in the financial institution does not necessarily identify your profit. If someone received a give or a lending, those funds are not considered earnings. And they would certainly not work into your revenue statement in determining your revenues.

While maybe that they have $18K in the account (and also that may not be true), your balance in the financial institution does not necessarily identify your profit. If someone received a give or a lending, those funds are not considered earnings. And they would certainly not work into your revenue statement in determining your revenues.Numerous things that you think are expenses and reductions are in truth neither. Accounting is the procedure of recording, identifying, and arranging a firm's economic purchases and tax filings.

A successful company calls for help from specialists. With practical objectives and a competent bookkeeper, you can quickly attend to obstacles and maintain those worries at bay. We devote our power to guaranteeing you have a strong monetary foundation for development.

5 Easy Facts About Stonewell Bookkeeping Shown

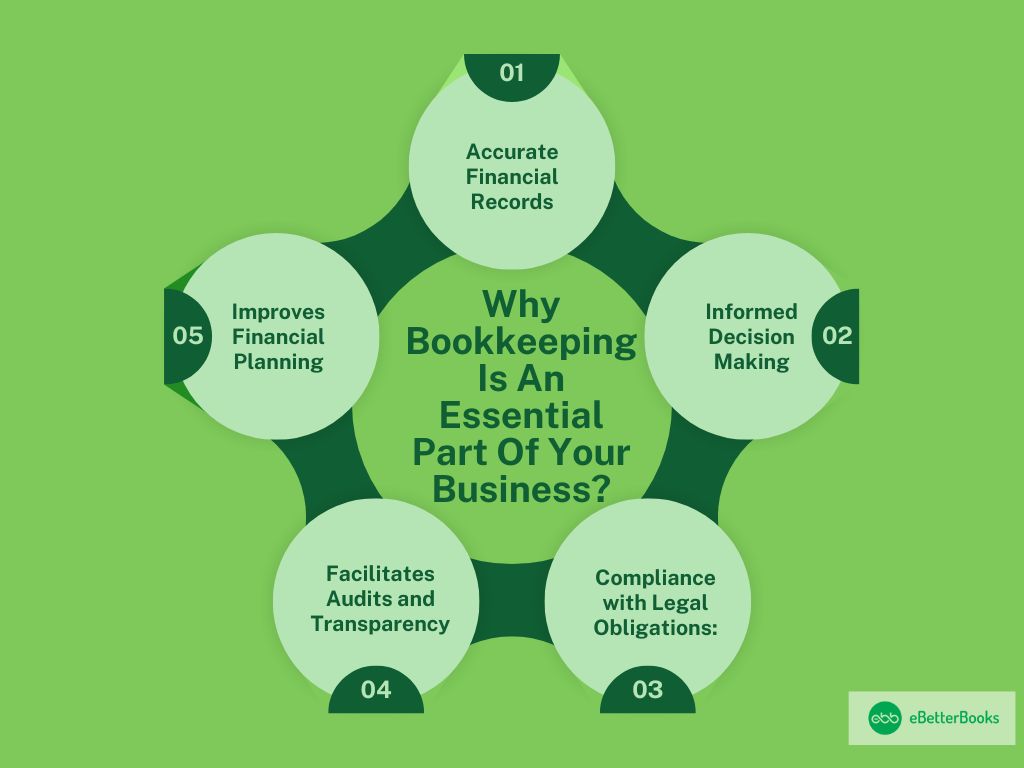

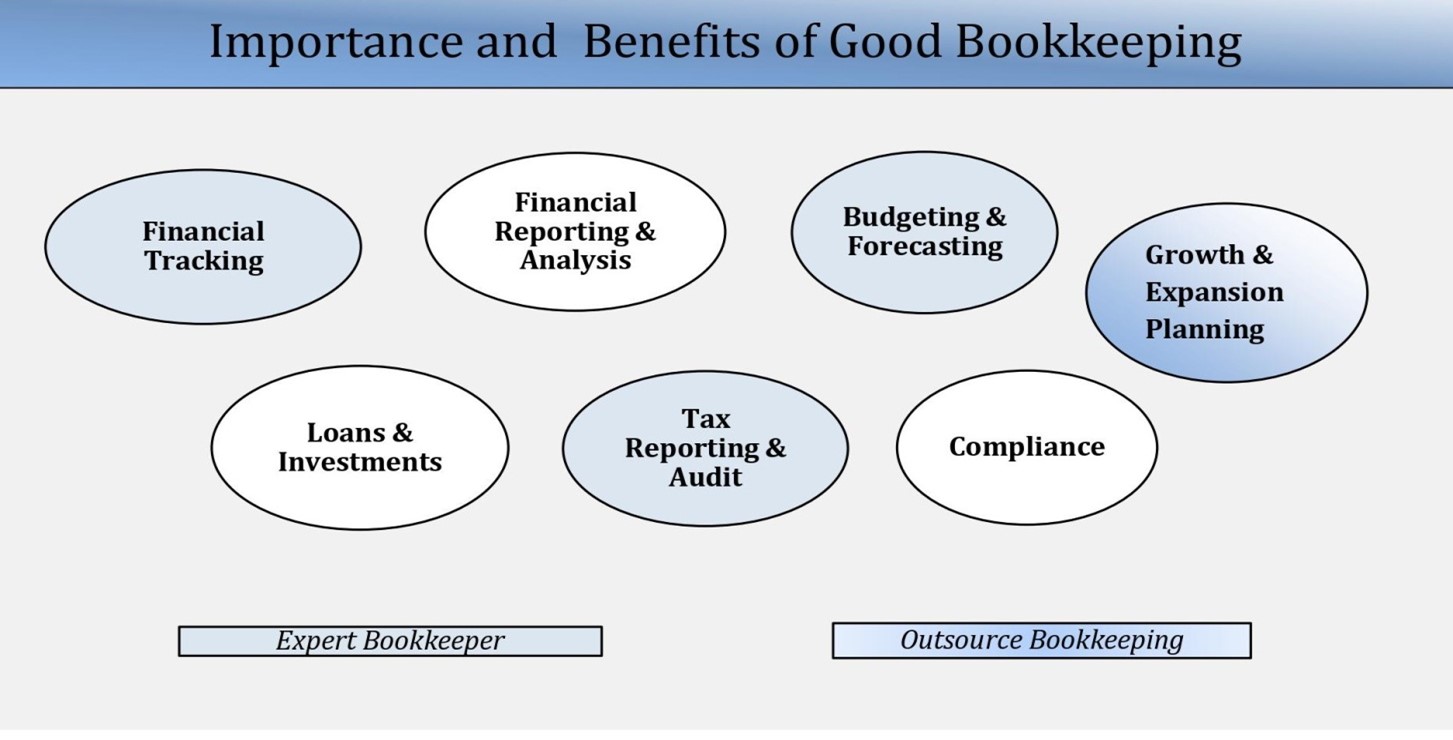

Precise bookkeeping is the foundation of good financial management in any organization. It assists track revenue and expenditures, making sure every transaction is tape-recorded effectively. With great bookkeeping, businesses can make better decisions since clear monetary records use valuable information that can direct technique and improve earnings. This details is crucial for long-lasting preparation and forecasting.Accurate monetary declarations construct trust fund with loan providers and investors, boosting your possibilities of getting the capital you need to expand., companies must frequently resolve their accounts.

They ensure on-time payment of bills and quick consumer settlement of invoices. This enhances cash flow and helps to stay clear of late fines. A bookkeeper will certainly go across bank statements with internal records at the very least top article when a month to find blunders or incongruities. Called bank reconciliation, this process ensures that the monetary documents of the business suit those of the bank.

Money Flow Declarations Tracks cash money movement in and out of the organization. These reports aid company owners recognize their economic setting and make informed choices.

The 8-Second Trick For Stonewell Bookkeeping

While this is cost-effective, it can be taxing and prone to errors. Tools like copyright, Xero, and FreshBooks allow service owners to automate bookkeeping tasks. These programs assist with invoicing, bank settlement, and economic coverage.

Report this wiki page